Table of contents

- How does Dental Insurance cover Braces?

- What is the cost of braces insurance?

- Getting Orthodontic insurance —Not Worth It!

- What is the average cost of braces??

- What is a type of insurance cover braces the cost of orthodontic treatment?

- Don’t have insurance covering braces. A Better Way to Pay for Braces?

- Take away

- Braces insurance FAQs

Do You Need Insurance to Get Braces?

The first question on everyone’s mind is often, “How much do braces cost?” The answer depends on your individual treatment plan.

Another common question is whether insurance will cover braces – metal or ceramic type of braces, or clear aligners. The answer: it varies depending on your insurance policy.

Orthodontics is a specialized field of dentistry that requires careful planning, time, and a deep understanding of tooth and jaw anatomy. Straightening teeth involves a preventative care to improved function, health, and appearance of your teeth. Given the expertise and time involved, orthodontic care can be a significant investment.

If you’re considering straightening your teeth, you’d ideally want the best orthodontic care available. However, we understand that budget constraints can be a concern, and you might be thinking about using dental insurance to cover the costs.

While insurance may help, it’s a misconception that you need insurance to afford orthodontic care. For specific plan, you would need pre-authorization for both in and out-of-network providers. Co-insurances can also be used for orthodontic care. Some dental and health plans won’t cover orthodontic services.

Some state insurance plans, including those under the Affordable Care Act, may offer coverage for orthodontic services to help you achieve a beautiful smile – e.g. Texas or Washington. However, the extent of coverage varies, so it’s important to review your plan to ensure it includes affordable care for braces.

There are plenty of affordable payment options available, and you don’t have to break the bank to achieve the smile you want. We’ll guide you through cost-effective solutions that can improve both your smile and your dental health—without compromising quality.

How does Dental Insurance cover Braces?

First, you probably want to know whether dental insurance even covers orthodontic treatment independent of the type of braces.

The answer is yes, most major dental coverage insurance providers offer benefits that extend to orthodontic care.

Insurance policies are often orthodontia coverage which has a lifetime maximum. Best dental insurance covers full cost of orthodontic treatment with a coverage limits – 50% of the treatment cost.

What is the cost of braces insurance?

Are you employed? Are you about thinking about what to change during the enrollment period? Do you currently have access to an attractive dental benefits plan?

If your children need different types of dental care often, it’s a good idea to have comprehensive dental coverage. A good dental plan can help pay for cost of braces and other important dental treatments.

Are you self-employed or looking for a more affordable dental insurance plan than what your employer offers?

Consider getting a dental savings plan. A dental savings plan is like a membership where you pay a yearly fee and get discounts at certain dentists.

Consider getting a dental savings plan. A dental savings plan is essentially a membership that you pay an annual fee for, and this membership entitles you to discounts with participating providers.

While membership is more affordable than a dental insurance plan, you will end up paying more out of pocket for treatments than you would with dental insurance coverage.

In the past, dental savings plans didn’t help out with orthodontic treatment. These days, however, people are becoming more aware of the benefits of orthodontic treatment and are seeking financing options. So you’re more likely to find a dental savings plan online that offers discounts on orthodontic care in certain locations.

Before buying dental insurance, make sure to research and understand the details of the plan. Understand which services are covered, which are not, and the costs you will have to pay out of pocket.

If you would like to learn more on how dental insurance works and how to choose the right dental care provider, check out this article on finding a dentist or orthodontist.

A dental benefits plan can be helpful if you have a family that needs a range of treatments, including crowns, fillings, cleanings, and braces.

But should you get a dental insurance plan if braces are the only treatment you need?

Nope. Let’s consider why.

Getting Orthodontic insurance —Not Worth It!

Some dental insurance plans cover orthodontic treatment, but it doesn’t always mean braces are completely free of charge. Considering all factors, dental insurance isn’t very useful for just getting braces.

Insurance companies usually do not cover treatment 100%. It doesn’t matter if your orthodontist is in-network or not. Most plans only cover a percentage of orthodontic treatment including x-rays and orthodontic appliances. 50% is common with a lifetime maximum of often $1000-$4000. Even with a high monthly premium, you would still need to pay for half of your treatment plan costs with some exclusions like jaw surgery.

Kids, only. Adults can get braces too, but many plans restrict orthodontic benefits to kids under the age of 18. It can be easy to assume that treatment for adults is covered if you don’t read your policy carefully.

High premiums. The best dental benefits plans are the most expensive ones designed for preventive dental services. Even with good orthodontic coverage, high monthly payments to the provider could offset any potential savings.

Copays and deductibles. Read that fine print before you take out a dental benefits plan.

If you buy insurance thinking it will cover braces, you might be surprised by extra costs such as copays or deductibles. A copay is the amount you pay each time you visit the doctor. A deductible is the total out-of-pocket amount you have to pay for your treatment before your insurance kicks in.

Waiting periods. Don’t rush to take out a dental coverage plan without knowing when you can start using it! Some plans have a required waiting period baked into them. A waiting period will require you to put your treatment on hold for several months.

Lifetime limits. Some dental insurance plans cover orthodontic treatment for adults, but it may only be available once in a lifetime.

This means that once you use those benefits, you have used them up. The maximum coverage amount doesn’t renew from year to year like coverage for other dental procedures does.

Orthodontic appliance restrictions. Some dental plans cover braces, but won’t cover clear aligners (invisalign) or other orthodontic appliances like lingual braces. If you want to use your insurance to pay for treatment, make sure it applies to the kind of treatment you’re interested in.

If your dental coverage plan covers orthodontic treatment and meets your family’s needs, take advantage of the benefits.

But if you don’t have or need such a comprehensive plan, why pay a high monthly premium to enjoy a small savings on orthodontic treatment?

And in general, the lower your insurance premium, the fewer the orthodontic treatment benefits you’ll receive. A cheap dental insurance plan may only pay $1,000 for orthodontic treatment, but the usual cost of the treatment plan is around $5,000. You will still need to pay the remaining cost not covered by your plan.

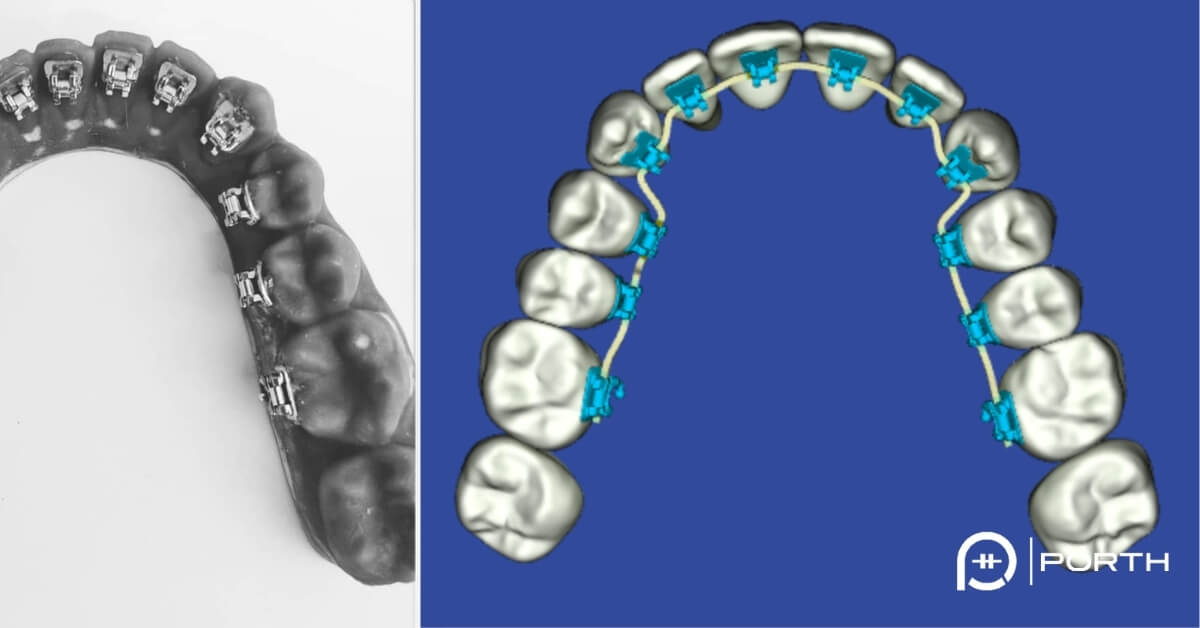

Treatment out of pocket cost depends on the complexity of the treatment. For example, fixing an overbite or spacing problems can cost different amounts based on the type of braces. The types of braces include traditional metal brackets, clear aligners, and lingual braces.

What about a dental savings plan?

Dental savings plans are more affordable than dental insurance, but they too don’t guarantee free treatment. You must pay an annual fee to receive discounts. However, these discounts may not be as substantial as those offered by more expensive dental insurance plans. Let’s just say you can’t pay $100 a year and expect a $3,000 discount on braces!

Having a dental insurance plan does not guarantee that you will get a good deal on braces. Dental insurance and savings plans can be useful for other treatments. However, they may not be necessary if you only need braces.

It’s important to consider your specific needs before deciding on a plan. Make sure to compare different options to find the best fit for you.

Let’s now talk about some better methods for financing orthodontic treatment.

What is the average cost of braces??

The cost of treatment for different types of braces depends on the complexity of misalignment and bite issues. At your free consultation, you will learn about the total cost of the treatment, out-of-pocket expenses, and insurance coverage.

Most orthodontic offices offer payment plans. You should also be able to use your flexible spending account. Traditional metal braces, clear braces, invisible braces, or self-ligating metal braces often have the same cost for braces treatment.

Medicaid also cover cost of orthodontic treatment. Not all offices accept medicaid because of the slow reimbursement amount.

Cost of braces ranges from $3000 to $15000. This huge range determined by the complexity of the treatement. Complex adult braces treatment are expensive. Fixing underbite with jaw surgery would cost more than the traditional braces.

What is a type of insurance cover braces the cost of orthodontic treatment?

Examples of healthcare insurance policies are:

– Delta dental

– Primera

– Aetna

These health insurance companies have both out of network and PPO healthcare providers including orthodontists. For braces or invisalign, the cost is the same most of the time.

Don’t have insurance covering braces. A Better Way to Pay for Braces?

You want an orthodontic financing plan that:

- Covers any treatment you need with no limitations on what kind of orthodontic appliance you use

- Cuts out the extra costs that might otherwise go into the pockets of middleman policy providers

- Has no waiting period, allowing you to begin treatment as soon as you need it

- Breaks down your treatment cost into affordable installments

- Clearly and simply states what is covered

- Has no age restrictions

- Potentially include a dental discount plan for all the dental work around orthodontic treatment

Does that list sound too good to be true?

It’s very true. And there are two ways that make this possible.

- HSA/FSA. If you already have dental insurance and a high deductible but the plan doesn’t provide enough coverage for orthodontic treatment, you can use your health savings account to pay for it.

Yes, orthodontic treatment is a qualifying medical expense! The same is true for flex spending accounts, although certain limitations may apply. Best of all, using your HSA or FSA to pay for your braces means that you use untaxed dollars to get straighter teeth.

- In-house financing. Many orthodontists offer in-office financing that allows you to break up the cost of your personalized treatment plan into manageable installments. This kind of payment plan is tailored to your unique situation and allows you to work one-on-one with the practice as you figure out the finances.

You don’t have to jump through hoops or comb through fine print to figure out which provider you’re allowed to see or what kind of treatment is covered. Everything you need will be covered under the in-house plan and it’ll be managed by people who know and care about you personally.

The best part about these two payment options is that anyone can benefit from them. If you already have dental insurance but aren’t happy with the orthodontic coverage, there’s no need to switch to a new plan. You can still use your HSA, FSA, or in-office financing to pay for your orthodontic treatment.

If you don’t have insurance at all, there’s no need to search for dental coverage just so that you can get braces. All you have to do is contact an orthodontist near you to learn more about an affordable payment plan.

Take away

Here’s the takeaway for this article: you don’t have to let dental insurance dictate the quality of oral health that you enjoy! You can still afford the benefits of straight teeth without being dependent on a dental coverage plan. The key is to learn what to expect from the treatment.

Do you live in Seattle or in one of the nearby areas like Sammamish or Bellevue? At PORTH, Dr. Rooz Khosravi provides a variety of orthodontic treatments including invisalign, traditional braces, lingual braces, and retainers. and yes we accept a wide variety of payment options. Our team works with many dental coverage plans, but we also offer flexible in-house payment plans for cost savings.

So if you don’t have dental coverage but still want braces, you don’t have to run out and get insurance before visiting us!

Visit PORTH for the most personalized orthodontic treatment plan—plus customized payment plan—in the Seattle area!

Braces insurance FAQs

Kaiser insurance have different policies. Most insurance plans cover a range of $1000 to $2500.

Orthodontic treatment is primairly covered by dental insurance. Medical insurance can cover part of orthodontic treatment combined with corrective jaw surgery.

The total cost of the treatment is indepenent of insurance coverage. Most offices offer payment plan to make the braces or Invisalign an affordable option especially without insurance coverage.